Contents [show]

FTX, FTX US and Alameda research has filed for bankruptcy. Information indicates that a lot of money has been lost. It is unclear if investor funds will be returned. Do not deposit money to any money belonging to the FTX group.

You can find another more reliable crypto broker by visiting Investing.co.uk. You can also read my review of Binance, FTX main competitor. Binance seems to be solvent at the moment, but there is no guarantee that they are in better shape the FTX was before the fall.

FTX is a cryptocurrency exchange owned by the company FTX. In early 2022, the exchange had over 1 million users.

FTX is a cryptocurrency exchange owned by the company FTX. In early 2022, the exchange had over 1 million users.

The company FTX is incorporated in Antigua and Barbuda but headquartered in The Bahamas. The FTX Digital markets Ltd. unit is regulated by the Securities Commission of the Bahamas.

Examples of entities that have invested in FTX are Softbank, Sequoia Capital, Binance, Temasek, Paradigm, Ontario Teachers’ Pension Plan Board, NEA, IVP, Vision Fund 2, Lightspeed Venture Partners, Steadview Capital, Tiger Global, and Insight Partners. Binance divested their shares in 2o21.

FTX in the United States

For legal reasons, FTX operates a separate exchange for United States traders. The main FTX exchange does not service United States traders; they need to use the FTX.US exchange instead. The trading assortment at FTX US is smaller than at the main FTX exchange.

FTX and FTX US have overlapping management teams but separate capital structures.

FTX.US is a money services business registered with The Financial Crimes Enforcement Network (FinCEN) in the United States. FinCEN is a government bureau administered by the U.S. Department of the Treasury.

In October 2021, FTX US acquired LedgerX and rebranded it FTX US Derivatives. FTX US Derivatives is licensed as a Derivatives Clearing Organization, Swap Execution Facility and Designated Contract Market by the U.S. Commodity Futures Trading Commission (CFTC).

Key products of the FTX (outside the United States)

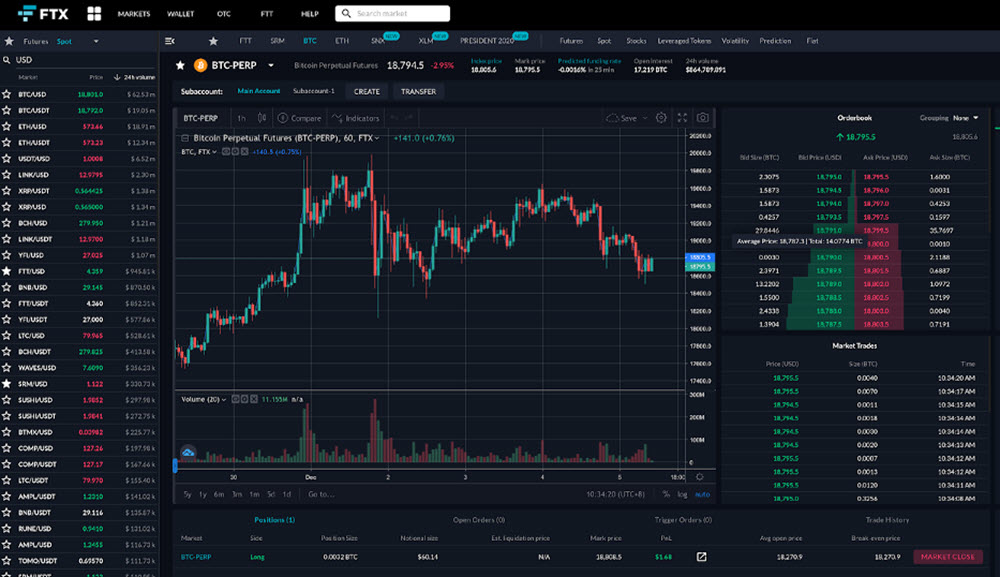

- Buying and selling cryptocurrency. Spot trading is available for over 300 different currency pairs. Examples of available pairs are BTC/USDT, XRP/USDT, ETH/USDT, and FTT/USDT.

- Derivative contracts involving cryptocurrency, including options, futures contracts and volatility products

- Leveraged trading

- NFT and collectable transactions

Short facts about the company FTX

Founded: 2019

Founders: Sam Bankman-Fried and Gary Wang

Headquarters: Nassau, The Bahamas

Website: ftx.com

Income: For the year 2021, the company FTX reported 1.02 billion USD in revenue and 388 million USD in net income.

The FTX cryptocurrency exchange

The platform

The FTX trading platform is available for desktop and in mobile apps. In addition to basic orders, more advanced orders can be used, such as trailing stop orders.

Currencies

There is support for around 300 cryptocurrencies and nine traditional currencies.

The nine traditional currencies are USD, EUR, GBP, AUD, CAD, CHF, ARS (Argentinian peso), BRL (Brazilian real), and GHS (Ghanaian cedi).

Important: Within certain limits, there is also support for certain other currencies, including the Turkish lira and the Japanese yen.

The FTX token

FTX has issued the cryptocurrency (“exchange token”) FTT. The initial release took place on May 5, 2019.

White paper: FTT Whitepaper.

FTX Ventures

FTX announced the $2 billion venture fund FTX Ventures in early 2022.

History

Foundation

FTX was founded in May 2019 by Sam Bankman-Fried and Gary Wang. Both are MIT graduates. Prior to founding FTX, Bankman-Fried worked as an ETF trader at Jane Street Capital.

Moving headquarters

FTX moved their headquarters from Hong Kong to The Bahamas in September 2021.

Examples of notable acquisitions

In August of the following year, FTX acquired the cryptocurrency portfolio tracking app Blockfolio for $150 million. In September 2022, FTX.US won the auction selling the digital assets of the bankrupt crypto brokerage Voyager Digital, a deal worth roughly $1.4 billion, including $1.3 billion in cryptocurrency.

Both deals fell through due to FTXs bankruptcy.

Misleading claims

In 2022, a tweet from FTX president Brett Harrison implied that FTX had FDIC insurance. The United States Federal Deposit Insurance Corporation (FDIC) responded with a cease-and-desist letter in August, which prompted Harrison to delete the tweet and Bankman-Fried to clarify in another tweet that FTX does not have FDIC insurance.